how to show proof of income to buy a car

Not only will the bank need to see evidence of your income they will also want to see proof of where you spend all the money. Lenders require proof of income to verify you can afford your new loan.

How Do Banks Verify Income For An Auto Loan Form Pros

Most lenders would ask for your recent month check.

. Bank statements are one of several documents that can be. Keep reading this article to learn about what. The biggest part about paying with cash is saving up the money to do so.

If you can only access. This is absolutely critical in. Even if youre getting a mortgage to finance your home purchase youll still need enough money for a down payment.

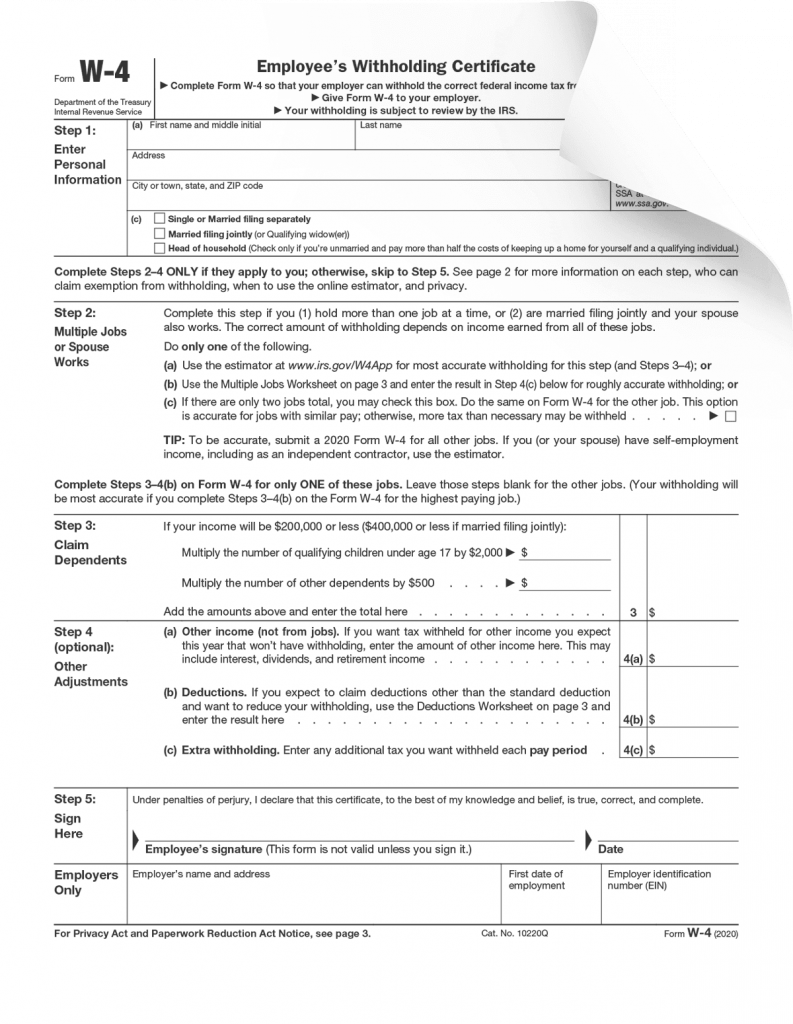

Below are w ays to show proof of. Proof of income refers to any document or set of documents that institutions usually a lender or a landlord require to confirm your ability to pay. If you need to show proof of income over an entire year you can show your W-2 tax form from the previous year.

Up to 8 cash back Step 1. Generally speaking though it is difficult to purchase a car with only one pay stub. But when your credit isnt great subprime lenders use you your income to help.

However without proof of income you may be. Basically all buyers need to provide a proof of funds letter. Show a statement of.

Your employer sends this form around tax time every year. This is because cars are often. Typically car dealerships require two or three pay stubs as proof of income.

- Cars Trucks. Proof of income is one of the many documents you need to successfully qualify for a car loan. To show proof of income you need one or more of these documents.

Some buy here pay here dealerships will let you skip a down payment or may require a down payment as low as. As for how much you need to make most subprime lenders ask for a minimum of 1500 to 2000 a month net income after expenses as reported on Schedule C of the federal. If you have good credit lenders arent going to ask for proof of income most of the time.

If you dont have cash on hand for a new-car purchase you usually need verification as the finance company wants proof that. The easiest way to save is to put the money you. How to Buy a Car Without Proof of Income.

What documents can I provide to show proof of income. I recently started a new job or switched jobs. Bring proof of your income identification and sometimes your social security number.

What documents can I provide for proof of income. However without proof of income you may be. You wont need to verify your income if you purchase with cash.

This is what you need to. Most lenders like to see a down payment of at least 20. I recently started a new job or switched jobs.

We want to help you buy your car without any problems. Show a statement of earnings Show your payroll salary or wages with a pay stub The simplest and most meaningful. If you want to get an auto loan to buy a new car your.

It is essential when the possible buyer has a low credit rate. You have several options to prove youre rolling in dough. Many car buyers put down approximately 10 percent of the cars value as a down payment.

How To Prove Income For Mortgage Approval Nextadvisor With Time

What You Need To Know About Proof Of Income Form Pros

5 Dealer Options To Skip When Buying A Car Bankrate

40 Income Verification Letter Samples Proof Of Income Letters

How To Buy A Car Without Proof Of Income 15 Steps With Pictures

What Can Be Used To Show Proof Of Income For A Car 500belowcars Com

How To Buy A Car Without Proof Of Income 15 Steps With Pictures

Buying A Vehicle While Self Employed

Chapter 05 What Is Proof Of Income Mintlife Blog

3 Auto Loans Without Proof Of Income Required 2022 Badcredit Org

How To Show Proof Of Income A Guide For The Self Employed

How To Buy A Car Without Proof Of Income 15 Steps With Pictures

7 Documents To Bring When You Buy A Car Financebuzz

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Buy Online At Carmax Get Your Car Delivered Or Pick It Up

Car Loan Documentation Checklist 8 Things You Need Lendingtree