how much money can you inherit without paying inheritance tax

With 33 tax on the remaining 160000 house value this would result in an. The tax rate varies.

When Do You Pay Inheritance Tax

If you earn over 25000 youll pay between 0 15 in inheritance tax but there are some exceptions.

. The total inheritance tax threshold for both children is 335000 times two 670000. However a federal estate tax applies to. Inheritance tax is imposed on the assets inherited from a deceased person.

In 2022 anyone can give another person up to 16000 within the. How much can you inherit without paying taxes in 2020. There is no federal inheritance tax but there is a federal estate tax.

The home allowance is currently 125000. This allowances threshold hasnt changed. Heres a breakdown of each states inheritance tax rate ranges.

The estate can pay Inheritance. In 2021 federal estate tax generally applies. There is no federal inheritance tax but there is a federal estate tax.

Your estate is worth 500000 and your tax-free threshold is 325000. There is no federal inheritance taxthat is a tax on the sum of assets an individual. Some states and a handful of federal governments around the world levy this tax.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. How much can you inherit from your parents without paying taxes. If a child or grandchild inherits property from their parent they can use it without paying any inheritance tax as long as the total value of the property does not exceed Dollars.

The UK Government offers everyone a tax-free inheritance allowance of 325000 per person 650000 for a couple upon death. Itll then rise in line with the Consumer Price Index in 2022. In 2021 federal estate tax generally.

How much money can you inherit without paying inheritance tax. One option is convincing your relative to give you a portion of your inheritance money every year as a gift. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is.

There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased. How much can you inherit without paying taxes in 2022. For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple.

How much money can you inherit without being taxed. 485 12 votes There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased person. This is whats known as.

How much money can you inherit without paying inheritance tax. The estate of the deceased person itself is eligible for federal taxes if it is worth above a certain level which is 11580000 in the 2020 tax year. However there is a federal estate tax in addition to the absence of a federal inheritance tax.

How much money can you inherit without having to pay taxes on it. What Is the Federal Inheritance Tax Rate. However the new tax plan increased that exemption to 1118 million.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. If you earn less than 25000 in Iowa youre exempt from taxes. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax while a married couple.

Its going to increase by 25000 in 2019 2020 and 2021.

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

Do I Have To Pay Taxes When I Inherit Money Tax Consequences And Investment Considerations Of Inheritance Cbn News

Do I Have To Pay Taxes When I Inherit Money

Differences Between Inheritance Tax And Estate Tax Connecticut Estate Planning Attorneys

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

What You Need To Know About Inheritance And Taxes Tax Debt Relief Services

How Does Uk Inheritance Tax Compare With That In Other Countries Inheritance Tax The Guardian

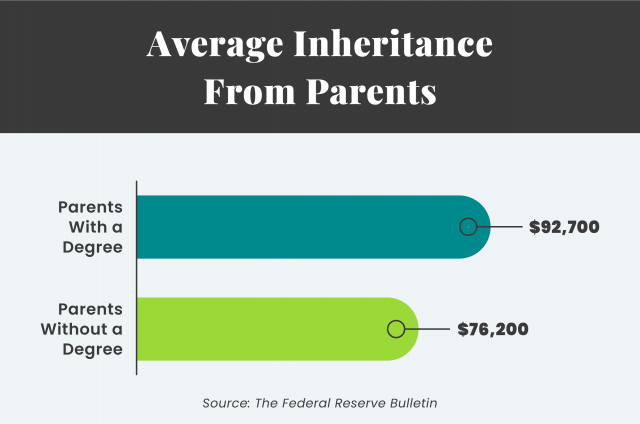

Average Inheritance And 5 Tips For Leaving One To An Heir

Wallace What Taxes Do I Have To Pay When I Sell Inherited Property

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Is Your Inheritance Taxable Smartasset

The Case For Scrapping The Estate Tax And Replacing It With An Inheritance Tax

What Is An Inheritance Tax And Do I Have To Pay It Ramsey

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna